Newest Emerging CBA

Built for Microfinance

An intelligent core banking platform built for Microfinance Banks and credit-focused institutions serving Africa’s informal and rural economies.

Our Mission

Chaincore is redefining core banking for the underserved.

From boardrooms to open markets

01

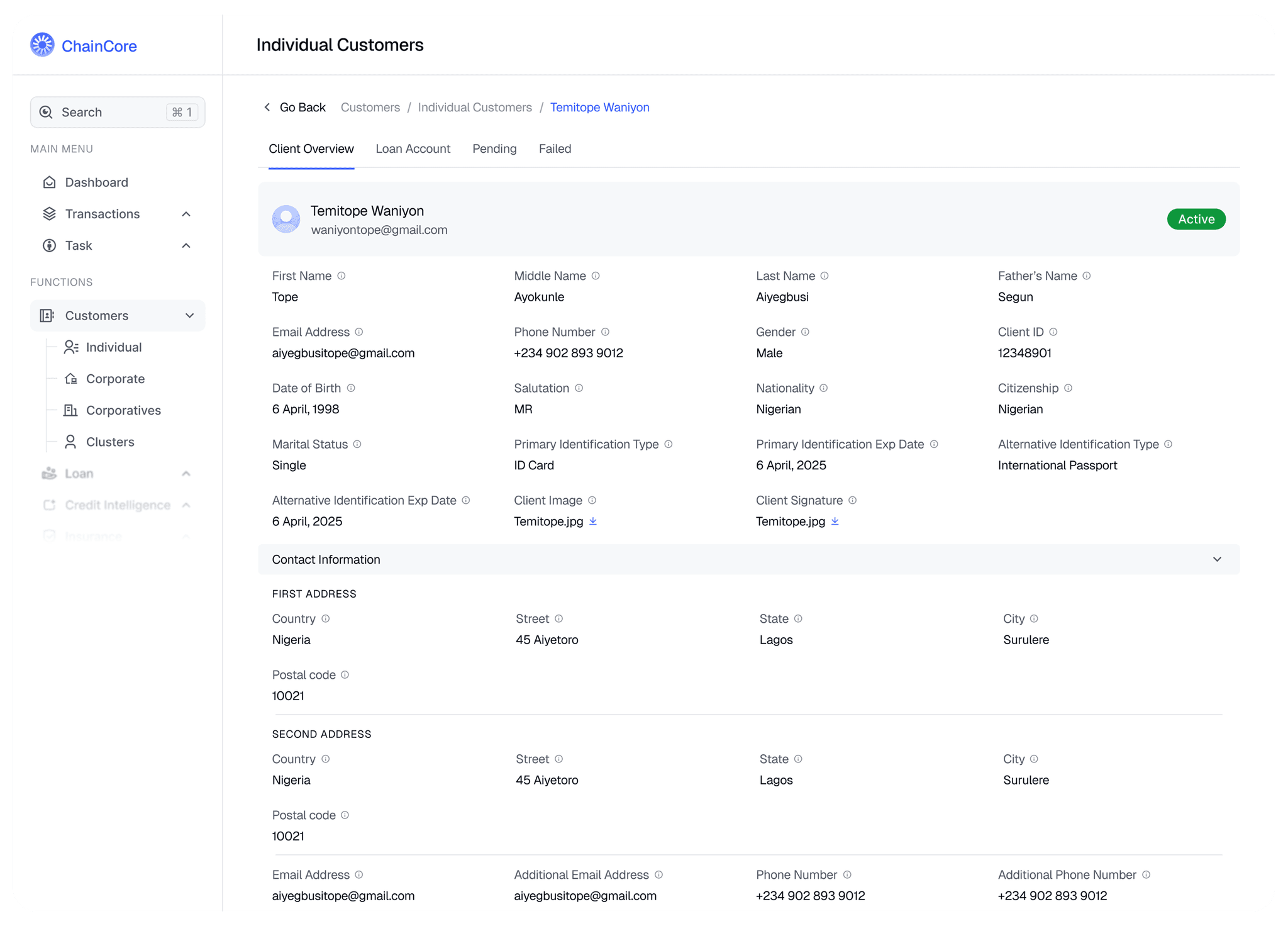

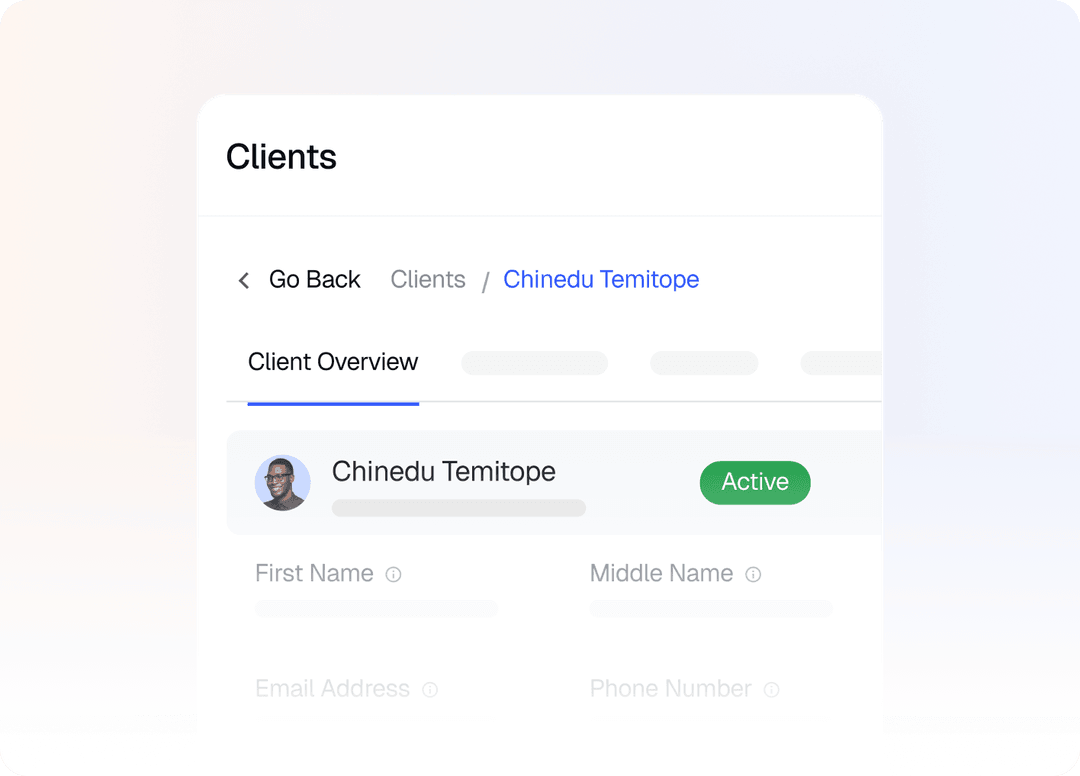

Manage customer accounts with ease

Open, track, and maintain accounts across all channels.

Ensure smooth operations with real-time account control.

02

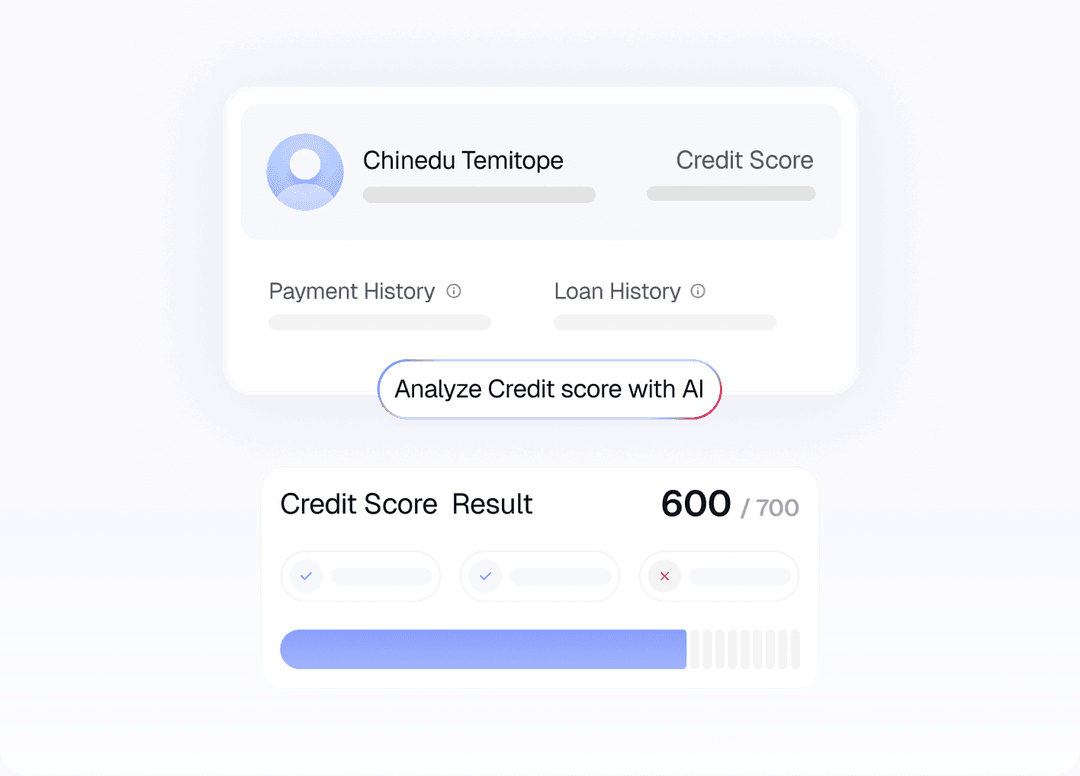

Assess credit risk using AI-driven insights

Analyze behavioral and financial data instantly.

Make smarter, faster lending decisions with confidence.

03

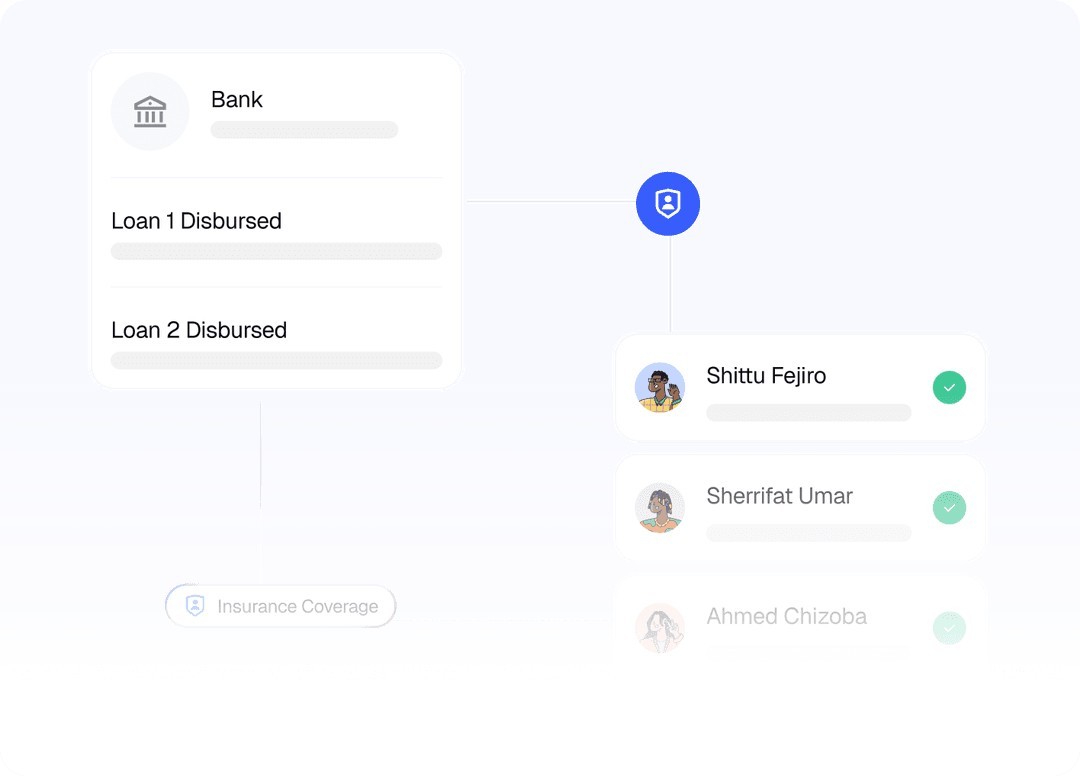

Disburse loans with built-in insurance coverage

Protect borrowers and lenders with embedded coverage.

Minimize risk while expanding credit access at scale.

04

Reach underserved and remote communities

Deliver financial services through mobile and agents.

Connect with customers beyond traditional bank reach.

Built-In Tools

Purpose-Built Features for African Financial Institutions

Pre-integrated solutions for faster, smarter operations.

AI-Powered Credit Scoring

Score first-time borrowers using behavioral, alternative, and mobile data. Unlock lending for the unbanked.

End-to-End Core Banking

Manage accounts, loans, ledgers, and compliance with a modern, secure platform built for African financial institutions.

Agent Toolkit & Offline Access

Onboard customers in rural areas through agents and field officers, with offline-first capabilities for low-connectivity zones.

Embedded Loan Insurance

Reduce defaults with auto-included business insurance on every disbursed loan integrated via API.

Intelligent Reporting & Risk Dashboard

Track credit performance, collections, fraud flags, and real-time repayment risk in a single interface.

Secure & Compliant

Built with Nigerian CBN/NDIC regulations in mind, and ready for deployment across evolving regulatory environments.

Who It's Built For

Empowering Institutions Driving Financial Access

From regulated banks to digital-first fintechs, Chaincore is built to power organizations focused on scale, innovation, and inclusion across Africa.

Built-In Tools

Trusted Partners

& Integrations

Chaincore is trusted by leading microfinance institutions and supported by seasoned industry experts.